When you search for Gabe Plotkin, it’s usually because something doesn’t quite add up, or you’re curious about the real story behind the headlines. Maybe you’ve seen his name tied to big wins, big losses, or heated debates, and it leaves you thinking “”. It’s normal to want clear answers instead of confusing financial talk that feels out of reach.

In this post, we break down who Gabe Plotkin is, why he became such a talked-about figure, and what actually matters in his story. You’ll get simple explanations, useful context, and insights that help everything make sense without the noise. By the end, you’ll feel informed, confident, and glad you kept reading.

Who is Gabe Plotkin?

Gabe Plotkin is an American hedge fund manager and businessman who gained worldwide attention during the GameStop short squeeze of 2021. He founded Melvin Capital Management and currently serves as co-chairman of the Charlotte Hornets NBA team.

Born in 1978 in Portland, Maine, Plotkin built his reputation on Wall Street through aggressive short-selling strategies. His career experienced dramatic highs with billions under management and equally dramatic lows with massive losses. Today, he manages his personal wealth through Tallwoods Capital LLC while owning majority stake in a professional basketball franchise.

His story represents both the opportunities and risks inherent in modern financial markets. From earning over $850 million in a single year to losing billions in days, Plotkin’s journey fascinates investors and casual observers alike.

Early Life and Educational Background

Gabriel Plotkin grew up in a modest Jewish family in Portland, Maine. His upbringing instilled values of hard work and perseverance that would define his career. The small-town environment shaped his character while providing a stable foundation for future ambitions.

He attended Northwestern University where he excelled academically in economics. Graduating magna cum laude and Phi Beta Kappa, Plotkin demonstrated exceptional intellectual capabilities early on. This academic excellence opened doors to prestigious Wall Street opportunities.

His education provided more than just knowledge. It connected him with influential networks and taught him analytical frameworks essential for finance. These college years laid the groundwork for his eventual rise in the hedge fund industry.

Career Journey on Wall Street

Plotkin began his professional journey in 2001 at Henry Crown and Company as a Private Equity Analyst. This entry-level position gave him exposure to investment evaluation and financial analysis. He quickly learned the fundamentals of equity research and portfolio management.

From 2003 to 2006, he worked at North Sound Capital in Connecticut as a Managing Director. Here he focused on consumer sector investments and honed his stock-picking abilities. This experience proved invaluable for understanding retail and consumer trends that would later define his strategy.

His most formative years came at SAC Capital Advisors under legendary trader Steve Cohen. At SAC’s Sigma Capital division, Plotkin managed a $1.8 billion portfolio of consumer-facing stocks. He developed expertise in identifying overvalued companies and profiting from their decline through short positions.

Founding Melvin Capital Management

In 2014, Plotkin launched Melvin Capital Management, named after his beloved grandfather Melvin. He started with $1 billion in capital, backed by mentor Steve Cohen and other prominent investors. This strong initial funding reflected Wall Street’s confidence in his abilities.

The firm focused on long-short equity strategies with emphasis on consumer stocks. Plotkin’s deep understanding of retail trends gave him an edge in identifying winners and losers. His research-intensive approach combined fundamental analysis with market timing.

Melvin Capital quickly established itself as a top-performing fund. The small team maintained a focused portfolio rather than diversifying across hundreds of positions. This concentrated approach amplified both gains and risks.

Spectacular Early Success

Melvin Capital’s first full year in 2017 delivered an astounding 47% return. This performance ranked it as the second-best hedge fund globally among those managing over $1 billion. Plotkin’s compensation that year reached an estimated $300 million.

By 2018, assets under management had grown to $3.5 billion. Investors clamored to allocate capital with the young manager who seemed to have a golden touch. His reputation as a shrewd short-seller spread throughout the industry.

The fund continued its winning streak through 2019 and 2020. Peak assets reached over $13 billion with consistent annual returns averaging 45% from 2015-2020. Plotkin’s strategy of betting against struggling companies in the digital age appeared unbeatable.

Investment Philosophy and Strategy

Plotkin specialized in identifying structurally challenged businesses disrupted by e-commerce and changing consumer habits. He would take large short positions in retailers, mall-based stores, and traditional media companies. This thesis aligned with observable trends toward online shopping and streaming entertainment.

| Investment Approach | Description |

| Primary Strategy | Long-short equity focused on consumer stocks |

| Core Expertise | Identifying overvalued companies facing disruption |

| Position Sizing | Concentrated bets rather than broad diversification |

| Research Method | Fundamental analysis combined with trend observation |

| Risk Management | Stop-losses and position limits (pre-GameStop) |

His risk management emphasized limiting losses on individual positions. However, the unprecedented retail trading phenomenon would expose weaknesses in this framework. No amount of traditional risk controls could prepare for what happened in January 2021.

The GameStop Saga: What Happened in January 2021?

Melvin Capital held a massive short position in GameStop stock believing the video game retailer faced inevitable decline. The company’s brick-and-mortar business model seemed doomed in the digital age. This thesis made logical sense based on traditional financial analysis.

However, retail traders on Reddit’s r/WallStreetBets community identified Melvin’s vulnerability. They organized a coordinated buying campaign to drive GameStop’s price higher. Their goal was to trigger a short squeeze forcing Plotkin to buy shares at inflated prices to close his position.

The strategy worked beyond anyone’s imagination. GameStop’s stock price skyrocketed from under $20 to peaks above $400. Melvin Capital lost approximately $6.8 billion during the squeeze with daily losses exceeding $1 billion at times.

The Emergency Bailout

As losses mounted catastrophically, Kenneth Griffin’s Citadel and Steve Cohen’s Point72 injected $2.75 billion into Melvin Capital. This emergency capital infusion aimed to stabilize the fund and prevent complete collapse. The bailout made headlines worldwide and symbolized Wall Street establishment rallying to support one of their own.

Despite the rescue, damage to Melvin’s reputation and capital base proved irreparable. Investors began questioning Plotkin’s risk management and whether he could recover. The fund struggled to regain its footing throughout 2021 and into 2022.

Public sentiment turned hostile toward Plotkin and other hedge fund managers involved. Social media portrayed him as a villain exploiting failing companies while retail traders became heroes. This narrative oversimplified complex market dynamics but resonated with millions.

Congressional Testimony and Media Scrutiny

Plotkin testified before Congress in February 2021 alongside Citadel’s Ken Griffin and Robinhood’s Vlad Tenev. He defended his investment strategy as legitimate market activity. The hearing examined whether market manipulation occurred and whether trading restrictions by brokers were justified.

Key points from his testimony:

- Melvin never asked brokers to restrict trading

- Short selling provides market liquidity and price discovery

- His fund conducted legal research-based investing

- He closed GameStop positions before restrictions occurred

Media coverage intensified with countless articles analyzing the event. The 2023 film “Dumb Money” featured Seth Rogen portraying Plotkin, bringing the story to mainstream audiences. This cultural moment cemented the GameStop saga in financial history.

Melvin Capital’s Closure in 2022

Despite the bailout, Melvin Capital never recovered its former performance. The fund posted further losses through 2021 and early 2022. Investor confidence eroded as redemption requests accelerated.

On May 18, 2022, Plotkin announced Melvin Capital would shut down and return remaining assets to investors. The decision came after sustained underperformance and inability to rebuild trust. Assets had dwindled from the peak of $13 billion to just a few billion.

The closure marked one of the most dramatic falls in hedge fund history. An industry titan who once earned $850 million annually now faced humbling defeat. Market observers debated whether this represented justice or an unfortunate outcome of unprecedented circumstances.

Gabe Plotkin Net Worth and Financial Status

Gabe Plotkin’s net worth is estimated between $400-500 million as of 2024. This represents a significant decline from his peak wealth before the GameStop losses. However, he remains substantially wealthy compared to average individuals.

| Year | Estimated Net Worth | Key Events |

| 2020 | ~$1 billion+ | Peak before GameStop, earned $850M in single year |

| 2021 | ~$600-700 million | After GameStop losses and emergency bailout |

| 2023 | ~$400-500 million | After Melvin closure, Charlotte Hornets purchase |

| 2024 | ~$400-500 million | Stable through Tallwoods Capital management |

His wealth comes from accumulated earnings during successful years at SAC Capital and Melvin Capital. Real estate holdings in exclusive locations contribute significant value. The Charlotte Hornets ownership stake represents a major asset likely to appreciate over time.

Plotkin invested his remaining capital strategically through his new family office. Rather than managing outside money, he focuses on long-term wealth preservation. This conservative approach contrasts sharply with his previous aggressive hedge fund tactics.

Charlotte Hornets Ownership

In June 2023, Gabe Plotkin and Rick Schnall purchased Michael Jordan’s majority stake in the Charlotte Hornets. The transaction valued the franchise at approximately $3 billion. Plotkin had been a minority investor since 2019 before stepping into the leadership role.

This acquisition represented a major pivot from pure financial investing to sports franchise ownership. NBA teams provide stable long-term assets with appreciation potential. The purchase also offered Plotkin an opportunity to rebuild his public image outside of hedge funds.

Michael Jordan retained a minority stake after the sale. His involvement from 2010-2023 stabilized the franchise despite on-court struggles. Plotkin and Schnall inherited a team with potential but needing strategic direction and investment.

Vision for Team Development

As co-chairman and rotating co-governor, Plotkin influences basketball operations and business strategy. His analytical background applies to player evaluation and franchise management. The Hornets require patient rebuilding to become competitive in the tough Eastern Conference.

Plotkin’s team priorities include:

- Developing young talent through improved coaching

- Upgrading facilities and training resources

- Enhancing fan experience and community engagement

- Strategic draft picks and smart free agent signings

The partnership with Rick Schnall brings complementary skills. Schnall’s experience with the Atlanta Hawks and understanding of NBA operations balances Plotkin’s financial acumen. Together they aim to transform the Hornets into a playoff contender.

Tallwoods Capital LLC: The New Beginning

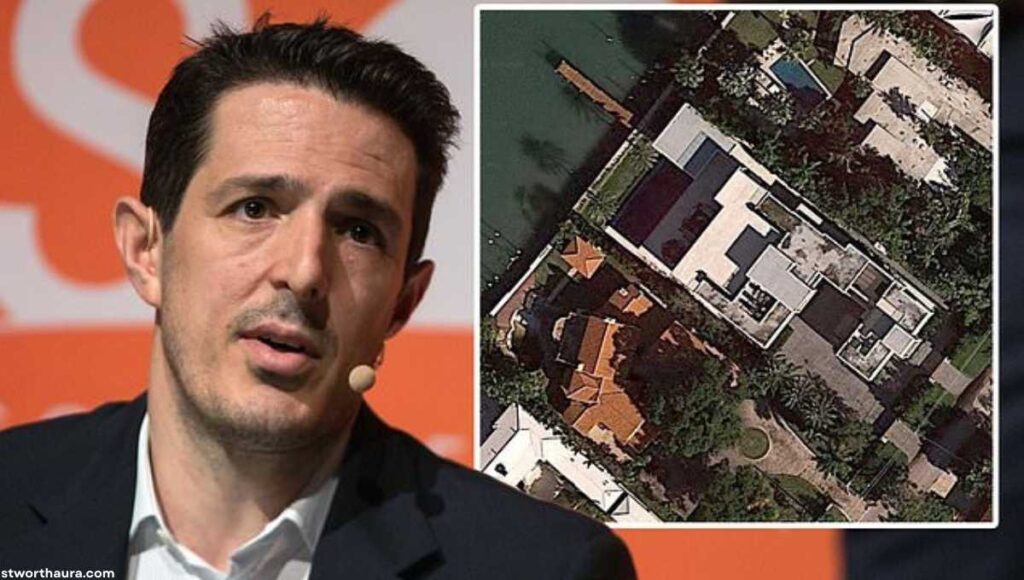

After closing Melvin Capital, Plotkin founded Tallwoods Capital LLC in 2022. Based in Miami Beach, Florida, it operates as a private family office managing only his personal wealth. This structure eliminates pressure from outside investors and allows longer time horizons.

Tallwoods invests across public equity, private equity, and real estate. The diversified approach reduces concentration risk that plagued Melvin Capital. Plotkin learned painful lessons about position sizing and market dynamics from the GameStop experience.

The family office model suits his current phase of life. With four children and a wife, Plotkin prioritizes wealth preservation over aggressive growth. He can make investment decisions without quarterly performance pressure or redemption concerns.

Investment Strategy Evolution

Tallwoods Capital reportedly focuses on long-term value investing rather than short-selling. This represents a significant philosophical shift from Melvin’s approach. Plotkin seeks quality companies at reasonable prices that can compound wealth over decades.

The firm’s investments include stakes in private companies like Rhone apparel alongside public market positions. Real estate holdings provide stable income and diversification. This balanced portfolio reflects hard-earned wisdom about risk management.

Performance details remain private due to the family office structure. However, Plotkin’s track record and analytical abilities suggest he can generate solid returns without taking excessive risks. The goal is steady compounding rather than spectacular gains.

Investment Philosophy and Strategy

Plotkin built his career on short-selling expertise, identifying overvalued companies facing structural challenges. He researched consumer trends, management quality, and competitive dynamics. When he found weak businesses, he would bet against them by borrowing and selling shares.

This contrarian approach requires conviction and risk tolerance. Short sellers face theoretically unlimited losses if stock prices rise instead of fall. Plotkin managed this risk through position limits and stop-losses before GameStop overwhelmed these safeguards.

His success came from recognizing shifts in consumer behavior earlier than others. The move from physical retail to e-commerce created numerous short opportunities. Companies slow to adapt often saw their stock prices decline as predicted.

Also Read About: Reena Sky Biography: Age, Height, Career & Net Worth 2026

Lessons from GameStop

The GameStop squeeze taught Plotkin several critical lessons:

- Social media can coordinate retail traders more effectively than previously imagined

- Short interest data is publicly available and can be weaponized against hedge funds

- Position concentration creates vulnerability to coordinated attacks

- Market sentiment sometimes overrides fundamental analysis

- Risk management systems designed for normal markets fail during manias

These insights now inform his Tallwoods Capital approach. He diversifies more broadly and likely avoids heavily shorted stocks. The painful experience reshaped his entire investment framework despite decades of prior success.

Modern hedge fund managers study the GameStop saga as a cautionary tale. It demonstrated that traditional institutional advantages have diminished in the social media age. Retail investors armed with apps and online forums can challenge even billionaire fund managers.

Personal Life and Family

Gabe Plotkin married Yaara Bank-Plotkin in 2006. They have four children together and maintain a relatively private family life. Despite public scrutiny from GameStop, they shield their children from media attention.

The family resides in Miami, Florida after relocating from the New York area. Miami’s favorable tax environment and lifestyle appeal to many wealthy families. The move also symbolized a fresh start after Melvin Capital’s closure.

Plotkin owns luxury real estate in exclusive locations including properties in the Hamptons and Florida. These assets reflect his substantial wealth despite recent professional setbacks. Real estate provides both personal enjoyment and investment diversification.

His wife Yaara shares his commitment to philanthropy. Together they established the Gabriel and Yaara Plotkin Family Foundation supporting various causes. This charitable vehicle allows them to give back meaningfully to communities they care about.

Philanthropy and Social Contributions

Plotkin serves on the board of advisors for the Children of Fallen Patriots Foundation. This organization provides college scholarships to children of military personnel killed in service. His involvement demonstrates commitment to supporting military families.

The Plotkin Family Foundation supports Jewish community organizations and veterans’ causes. Major donations have gone to Chabad of Southampton and the Wounded Warrior Project. These contributions reflect both his heritage and appreciation for military service.

His philanthropic philosophy emphasizes education and supporting vulnerable populations. Rather than seeking publicity for donations, the Plotkins give quietly and consistently. This approach aligns with Jewish traditions of charitable giving.

While the GameStop controversy damaged his public image, philanthropic work continues behind the scenes. Plotkin recognizes that wealth brings responsibility to help others. His charitable activities provide purpose beyond financial success.

Controversies and Public Perception

The GameStop saga transformed Plotkin from an obscure hedge fund manager into a controversial public figure. Retail traders portrayed him as a villain profiting from failing companies. Social media amplified this narrative with memes and harsh criticism.

His congressional testimony faced intense scrutiny. Critics questioned whether he truly understood the risks of massive short positions. Supporters argued he became an unfair scapegoat for systemic issues in financial markets.

Public opinion remains divided:

- Critics view him as representing Wall Street greed and manipulation

- Supporters see him as conducting legal investment research

- Some acknowledge both perspectives have merit

The “Dumb Money” film brought renewed attention to the controversy in 2023. Seth Rogen’s portrayal presented a somewhat sympathetic but flawed character. The movie introduced the story to audiences unfamiliar with the original events.

Impact on the Hedge Fund Industry

GameStop forced the entire hedge fund industry to reassess short-selling strategies. Managers now consider social media sentiment and retail trading coordination as serious risks. Disclosure of short positions on public filings creates vulnerability to targeted squeezes.

Many funds reduced short exposure or avoided highly shorted stocks entirely. Risk management protocols were updated to account for unprecedented volatility. The event proved that crowdsourced trading could challenge even sophisticated institutional investors.

Regulatory discussions emerged about market structure and trading restrictions. Questions arose about payment for order flow, short selling disclosures, and broker responsibilities. These debates continue influencing policy discussions today.

The incident accelerated the democratization of financial markets. Retail investors gained confidence that they could impact outcomes previously controlled by institutions. Trading apps and social media permanently changed market dynamics in ways still unfolding.

Comparison with Other Hedge Fund Managers

| Manager | Peak AUM | Defining Moment | Current Status |

| Gabe Plotkin | $13 billion | GameStop losses | Family office, Hornets owner |

| Bill Ackman | $20 billion+ | Various activist campaigns | Still managing Pershing Square |

| Steve Cohen | $16 billion | SAC Capital settlement | Point72, Mets owner |

| Ken Griffin | $50 billion+ | Multiple market events | Still running Citadel successfully |

| David Einhorn | $10 billion+ | Various short calls | Greenlight Capital continues |

Unlike many peers who weathered controversies, Plotkin chose to exit the traditional hedge fund business. His relatively young age (born 1978) meant this career change came during what should have been his prime years. Other managers like Griffin and Cohen overcame scandals to reach even greater heights.

His transition to sports ownership mirrors Cohen’s purchase of the New York Mets. Successful hedge fund managers often diversify into sports franchises. These assets provide prestige, stable value appreciation, and enjoyable involvement beyond pure finance.

Media Presence and Public Image

Plotkin maintains an extremely low public profile compared to other wealthy investors. He rarely gives interviews and has no social media presence. This privacy preference existed before GameStop but intensified afterward.

His approach contrasts with managers like Bill Ackman who embrace media attention. Plotkin prefers letting performance speak rather than courting publicity. This strategy suited him during successful years but left him vulnerable when controversy erupted.

The “Dumb Money” portrayal shaped public perception significantly. Most viewers knew little about Plotkin before watching Seth Rogen’s performance. The film presented him as smart but overconfident and disconnected from retail investors’ perspectives.

Moving forward, Plotkin seems content to rebuild privately. His Charlotte Hornets role provides some public visibility but on his own terms. Time may soften his controversial image as new financial stories capture attention.

Future Outlook and Prospects

Tallwoods Capital gives Plotkin freedom to invest without external pressure. He can hold positions for years and make contrarian bets. This patient approach may yield excellent long-term results without headline-grabbing drama.

The Charlotte Hornets represent a multi-decade project. Building a championship contender takes time, capital, and smart decision-making. Success would significantly improve his public image and provide immense personal satisfaction.

At 46 years old in 2024, Plotkin has decades ahead to apply hard-won lessons. The GameStop experience, while painful, provided valuable insights about markets and risk. Many successful investors faced major setbacks before achieving lasting success.

His analytical skills and work ethic remain intact despite one catastrophic event. The question is whether he can translate those abilities into new domains. Sports franchise management requires different skills than hedge fund trading.

Frequently Asked Questions About Gabe Plotkin

What is Gabe Plotkin’s current net worth?

Gabe Plotkin’s net worth is estimated between $400-500 million as of 2024. This declined from over $1 billion before the GameStop losses but remains substantial.

Does Gabe Plotkin still manage money?

Yes, he manages his personal wealth through Tallwoods Capital LLC, a private family office. He no longer manages money for outside investors after closing Melvin Capital.

What happened to Melvin Capital?

Melvin Capital shut down in May 2022 after never recovering from the January 2021 GameStop short squeeze. The fund returned remaining assets to investors.

How much did Plotkin lose in GameStop?

Melvin Capital lost approximately $6.8 billion during the GameStop squeeze. Plotkin’s personal losses were substantial but exact figures remain private.

Is Gabe Plotkin still involved in Charlotte Hornets?

Yes, he is co-chairman and majority owner of the Charlotte Hornets NBA franchise alongside partner Rick Schnall. They purchased Michael Jordan’s stake in 2023.

Where is Gabe Plotkin now?

He lives in Miami, Florida and manages Tallwoods Capital while overseeing the Charlotte Hornets. He maintains a low public profile.

What is Tallwoods Capital?

Tallwoods Capital LLC is Plotkin’s private family office founded in 2022. It invests in public equity, private equity, and real estate only for his personal portfolio.

Did Gabe Plotkin do anything illegal?

No, Plotkin was never charged with any illegal activity. Short selling is legal and regulated. The GameStop losses resulted from market dynamics, not illegal behavior.

How did Gabe Plotkin make his money?

He made his fortune managing hedge funds, first at SAC Capital then founding Melvin Capital. His compensation in peak years exceeded $850 million annually.

What was Gabe Plotkin’s role in GameStop?

Plotkin’s Melvin Capital held large short positions in GameStop believing it was overvalued. When retail traders drove the price up, his fund lost billions triggering the larger controversy.

Conclusion

Gabe Plotkin is a name that still creates strong reactions. Some people feel curious. Others feel confused. Many still search for clear answers. Gabe Plotkin became famous during a tense moment in the market. That moment changed how people talk about investing. It also changed trust. When readers look up Gabe Plotkin, they often feel unsure and think “”. That feeling is normal. Big money stories can feel distant and stressful. But understanding the basics helps calm that noise.

At the end of the day, learning about Gabe Plotkin is about learning bigger lessons. Gabe Plotkin shows how fast success and loss can happen. His story reminds readers to stay informed. It reminds them to ask questions. By understanding Gabe Plotkin, you gain clarity, not hype. You also gain confidence. And that makes reading worthwhile.